Unlock The Power Of Homestead Exemption In DeSoto County MS

So here's the deal, if you're living in DeSoto County, Mississippi, and you're a homeowner, you need to know about homestead exemption. It's like this hidden gem that can save you a ton of money on your property taxes. Yeah, you heard me right. Property taxes can be a real headache, but with homestead exemption, you can lighten that load significantly. And guess what? It's not as complicated as it sounds. Stick around, and I'll break it down for you in a way that's easy to understand.

Now, let's dive a little deeper into why this matters. Property taxes in DeSoto County can be hefty, and who doesn't want to save some cash? Homestead exemption is basically a tax break for homeowners, and it can make a real difference in your annual budget. But here's the thing, not everyone knows about it, and even fewer people take full advantage of it. That's where this article comes in. We're going to explore everything you need to know to claim your rightful exemption.

And don't worry, I won't bore you with a bunch of legal jargon. We're keeping it real, breaking it down in a way that makes sense. Whether you're a long-time resident or a newcomer to DeSoto County, understanding homestead exemption is crucial. So, let's get started and uncover how you can save big on your property taxes.

Read also:How Old Is Anne Ornish Discovering The Life And Legacy Of A Health Advocate

What Exactly is Homestead Exemption?

Homestead exemption is basically a tax break that reduces the amount of property tax you owe on your primary residence. It's like a reward for owning a home, and it helps lower the tax burden on homeowners. In DeSoto County, MS, this exemption can make a significant impact on your annual property tax bill. But here's the kicker, you gotta claim it. It's not automatic, so you need to take the initiative to apply.

Think of it as a discount on your property taxes. The exemption lowers the assessed value of your home, which directly translates to lower taxes. For example, if your home is assessed at $100,000 and you qualify for a $50,000 exemption, you only pay taxes on the remaining $50,000. That's a huge savings, right? And the best part? It's a benefit that's there for the taking if you know how to claim it.

So, why does this matter? Well, property taxes can eat up a big chunk of your budget, and homestead exemption helps ease that financial strain. It's like having a secret weapon in your financial arsenal. By understanding how it works and how to apply, you can keep more of your hard-earned money in your pocket. Let's move on and explore who qualifies for this awesome benefit.

Who Qualifies for Homestead Exemption in DeSoto County MS?

Alright, so not everyone can claim homestead exemption, but the good news is, a lot of people do qualify. To be eligible, you need to own and occupy your home as your primary residence in DeSoto County, MS. That means it's the place where you live most of the time. If you own multiple properties, only your main home qualifies for the exemption.

Here's a quick rundown of who can apply:

- Homeowners who live in DeSoto County

- Must own the property outright or be in the process of paying off a mortgage

- No age restrictions, so whether you're young or old, you can still qualify

- Must have lived in the home as of January 1st of the tax year you're applying for

And there's more good news. Certain groups, like senior citizens and disabled individuals, may qualify for additional exemptions or higher exemption amounts. We'll get into those specifics later, but for now, just know that if you own and live in your home in DeSoto County, you're likely eligible for this tax-saving benefit. Let's keep rolling and find out how to apply.

Read also:Journal Of Multicultural Counseling Development A Comprehensive Guide To Cultural Competence

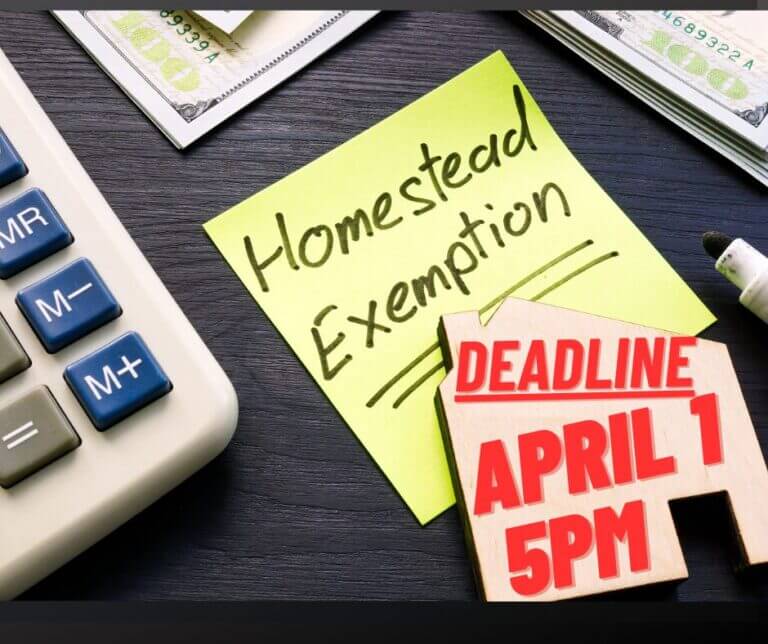

How to Apply for Homestead Exemption in DeSoto County MS

So, you've figured out that you qualify for homestead exemption. Great! Now, let's talk about how to apply. The process is pretty straightforward, but there are a few steps you need to follow to make sure everything goes smoothly. First things first, you need to contact the DeSoto County Tax Assessor's Office. They're the ones who handle all the paperwork and approvals.

Here's what you need to do:

- Fill out an application form. You can usually get this form online or in person at the Tax Assessor's Office.

- Provide proof of ownership, like your deed or mortgage statement.

- Show proof of residency, which could be a utility bill or driver's license with your current address.

- Submit your application by the deadline, which is usually around March 1st each year.

Once you've submitted your application, the Tax Assessor's Office will review it and let you know if you've been approved. It's a pretty quick process, and if everything checks out, you'll start seeing the savings on your next tax bill. Easy peasy, right? Now, let's talk about the benefits of homestead exemption and why it's worth the effort.

Benefits of Homestead Exemption

Alright, so you're probably wondering, "What's in it for me?" Well, let me tell you, the benefits of homestead exemption are pretty sweet. First and foremost, it saves you money on your property taxes. Depending on the value of your home and the exemption amount, you could be looking at some serious savings. And who doesn't love saving money?

But the benefits don't stop there. Homestead exemption also provides a level of financial stability. Knowing that you have this tax break in place can help you better plan your budget and avoid any nasty surprises when tax season rolls around. Plus, if you're on a fixed income, like many retirees are, this exemption can make a big difference in your monthly expenses.

And here's another cool thing. In some cases, homestead exemption can protect your home from being sold to pay off debts. Yeah, it's like an added layer of security that gives you peace of mind. So, not only are you saving money, but you're also safeguarding your most valuable asset. Now, let's check out some common questions people have about homestead exemption.

Frequently Asked Questions About Homestead Exemption

Alright, so you've got the basics down, but you probably still have some questions. Don't worry, that's totally normal. Let's tackle some of the most common questions people have about homestead exemption in DeSoto County, MS.

Q: Can I still claim homestead exemption if I have a mortgage?

A: Absolutely! As long as you own the home and live in it as your primary residence, you can claim the exemption, even if you're still paying off your mortgage.

Q: What if I own multiple properties?

A: Only your primary residence qualifies for homestead exemption. If you own other properties, they won't be eligible for this tax break.

Q: Is there an age requirement?

A: Nope! Anyone can apply for homestead exemption, regardless of age. However, seniors and disabled individuals may qualify for additional exemptions.

Q: What happens if I move?

A: If you move to a new home, you'll need to reapply for homestead exemption at your new address. The exemption is tied to the property, not the person.

Got more questions? Don't hesitate to reach out to the DeSoto County Tax Assessor's Office. They're there to help and can provide more detailed information if you need it. Now, let's move on and talk about some additional exemptions you might qualify for.

Additional Exemptions for Seniors and Disabled Individuals

So, here's the deal. If you're a senior citizen or a disabled individual, you might qualify for additional homestead exemptions in DeSoto County, MS. These exemptions can provide even more savings on your property taxes, which is always a good thing. Let's break it down.

Senior Citizen Exemption:

If you're 65 years or older, you might be eligible for an additional exemption. This can further reduce the assessed value of your home, leading to even lower property taxes. To qualify, you'll need to provide proof of age, like a birth certificate or driver's license.

Disabled Individuals Exemption:

If you're disabled, you may also qualify for an additional exemption. This can provide significant tax relief and help ease the financial burden of homeownership. To apply, you'll need to provide documentation of your disability, such as a Social Security award letter or a VA disability rating.

Both of these additional exemptions can make a big difference in your tax bill, so it's definitely worth checking out if you qualify. And remember, you can apply for these exemptions at the same time you apply for regular homestead exemption. Let's keep going and talk about some tips for maximizing your savings.

Tips for Maximizing Your Homestead Exemption

Alright, so you know how to apply and who qualifies, but how can you make sure you're getting the most out of your homestead exemption? Here are a few tips to help you maximize your savings:

- Apply early. Don't wait until the last minute to submit your application. The earlier you apply, the sooner you'll start seeing the savings.

- Check for errors. Make sure all the information on your application is accurate. A small mistake could delay the approval process.

- Stay informed. Keep up with any changes in tax laws or exemption rules. The DeSoto County Tax Assessor's Office usually updates their website with the latest info.

- Renew annually. Remember, you need to reapply each year to maintain your exemption status.

By following these tips, you can ensure that you're getting the full benefits of homestead exemption. Now, let's wrap things up and summarize everything we've covered.

Conclusion: Take Advantage of Homestead Exemption in DeSoto County MS

So there you have it, everything you need to know about homestead exemption in DeSoto County, MS. It's a powerful tool that can help you save big on your property taxes and provide financial stability. Whether you're a long-time resident or a newcomer, understanding and applying for homestead exemption is crucial. And don't forget, if you're a senior or disabled individual, you might qualify for additional exemptions that can further reduce your tax burden.

Remember, the key is to take action. Don't wait for someone else to tell you about this benefit. Apply early, provide all the necessary documentation, and make sure you're getting the full advantage of homestead exemption. And if you have any questions or need more information, the DeSoto County Tax Assessor's Office is there to help.

Now, I want to hear from you. Have you already claimed your homestead exemption? Or are you planning to apply soon? Drop a comment below and let me know. And if you found this article helpful, don't forget to share it with your friends and family. Together, we can help more homeowners in DeSoto County save money on their property taxes.

References

For more detailed information on homestead exemption in DeSoto County, MS, check out these resources:

- DeSoto County Tax Assessor's Office - [website link]

- Mississippi Department of Revenue - [website link]

- IRS Guidelines on Property Tax Deductions - [website link]

Table of Contents

- What Exactly is Homestead Exemption?

- Who Qualifies for Homestead Exemption in DeSoto County MS?

- How to Apply for Homestead Exemption in DeSoto County MS

- Benefits of Homestead Exemption

- Frequently Asked Questions About Homestead Exemption

- Additional Exemptions for Seniors and Disabled Individuals

- Tips for Maximizing Your Homestead Exemption

- Conclusion: Take Advantage of Homestead Exemption in DeSoto County MS

- References